Understand the core principles and lifecycle of Advance Payments

This article explains the core principles and lifecycle of advance payments in the Czech version.

Core principles

- Document matching happens at the header level. Invoice headers are matched to advance payment headers.

- Advance payment settlements are posted using the Advance Letter G/L Account defined in the Advance Letter Templates.

- Most actions related to advances are initiated directly from the corresponding Adv. Letter Entries. For example:

- From a Payment type entry, you can post an Payment VAT or execute the Unlink Advance Payment function.

- From a VAT Payment type entry, you can post a Credit Memo VAT (for reversal) or print the Advance VAT Document.

- Posting an advance VAT document or credit memo doesn't generate a separate document header. Only entries in the Advance Letter Entries, from which the relevant VAT documents can be printed.

- In the General Journal (or Cash Receipt Journal), the Document Type field must contain Payment for settling an advance. Also, the payment must be linked to the advance using the Advance Letter No. field.

- Fields such as Advance Letter No. and Adv. Letter Template Code are available on customer and vendor ledger entries, and the **Advance Letter No. field is also present on VAT Entries.

- In VAT Entries, advances post with the VAT Calculation Type field set to Normal VAT, and use the standard Base field for the VAT base amount.

Advance payment lifecycle

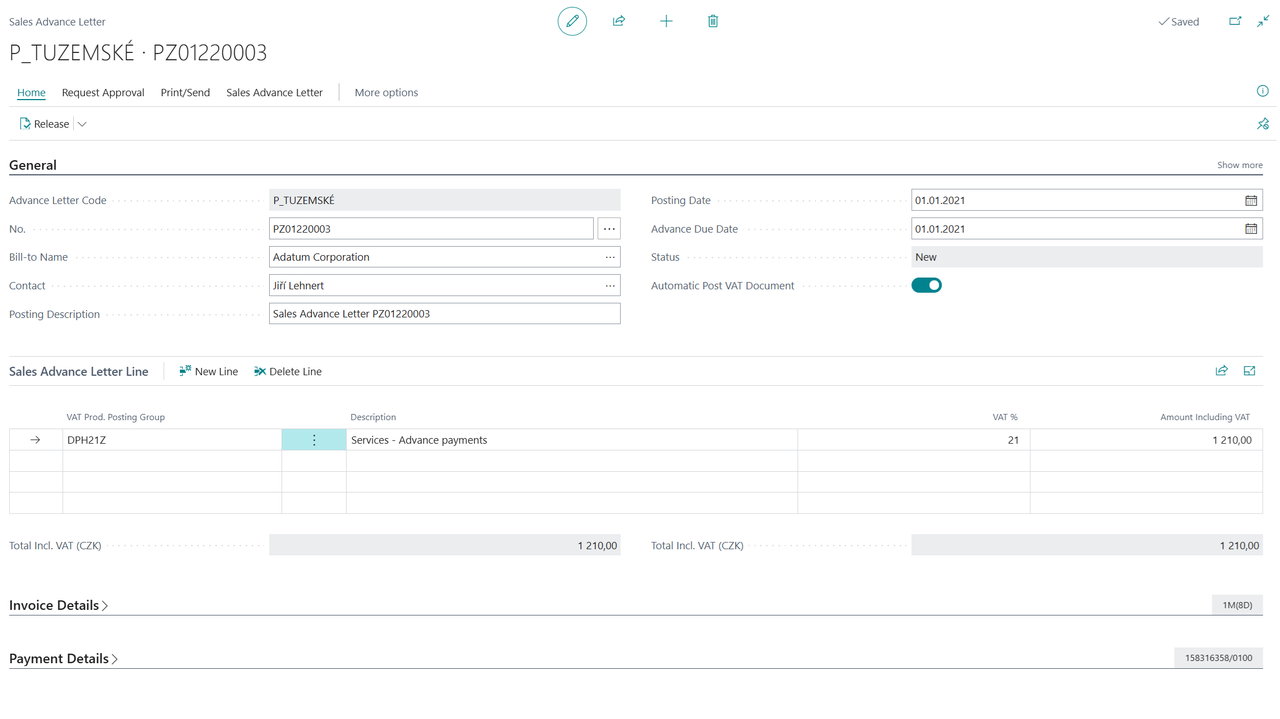

The entire lifecycle of an advance is available from the Sales (or Purchase) Advance Letter page. The page lists all historical advance entries and you can access all related functions. For example, you can post VAT documents and credit memos, close an advance, run reports, and so on.

The Status field shows the current stage of the advance. For example, whether the advance is issued, paid, or applied.

- When the advance is created, its Status is set to New.

- When the advance is issued, its Status changes to To Pay. An Initial Entry is created, and the advance is ready for settlement.

- When the advance is paid via cash or a general journal, its Status becomes To Use. The advance is ready to be applied to a final document. Payment and/or VAT payment entries are generated.

- When the advance is fully applied to an invoice, the Status is set to Closed.

- If the advance isn't fully applied, you can close it manually. Doing so changes the Status to Closed, and the system generates Close, VAT Close, and reversing Initial Entry entries.

Related information

Advance Payments for Czech Republic (Extension)

Czech Local Functionality

Finance