Extra features for Advance Payments (Corrections)

In addition to core functionality such as creating, paying, and applying advances, the Advance Payments application also provides several supplementary features to simplify work with advance documents. These extra features let you do things like:

- Reverse an advance VAT document.

- Unlink an incorrect payment from an advance.

- Add a payment to an advance retrospectively.

- Unapply an advance from a posted invoice.

- Add an advance to a posted invoice.

Reverse an Advance VAT document

Use this function when you need to reverse a VAT document you mistakenly posted for a purchase advance payment.

To reverse an advance VAT document:

- Choose the

icon, enter Purchase Advance Letters, and then choose the related link.

icon, enter Purchase Advance Letters, and then choose the related link. - In the list, locate the paid purchase advance letter with a posted VAT document. Use the Advance Letter Entries function.

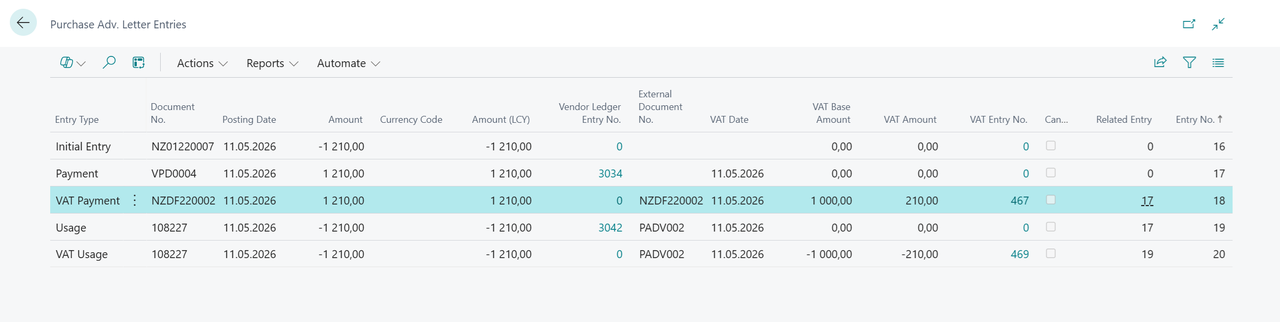

In the list of purchase advance letter entries, choose the line with Entry Type – VAT Payment.

- Choose the Post Credit Memo VAT action.

- A page opens with prefilled information from the VAT Payment line. Review and confirm with OK.

- A new entry with Entry Type – VAT Payment and an opposite sign is created. The entry is reflected in both the general ledger and VAT entries.

To post a new VAT document for the advance again, choose the Payment line, and then choose Post Payment VAT.

Unlink an incorrect payment from an advance

If an incorrect payment is linked to an advance, you can unlink it from the advance letter entries using Unlink Advance Payment. Unlinking is only possible if the payment isn't applied to a final document.

To unlink a payment from an advance:

- Choose the

icon, enter Purchase Advance Letters, and choose the related link.

icon, enter Purchase Advance Letters, and choose the related link. - In the list, find the paid purchase advance letter.

- Use the Advance Letter Entries function.

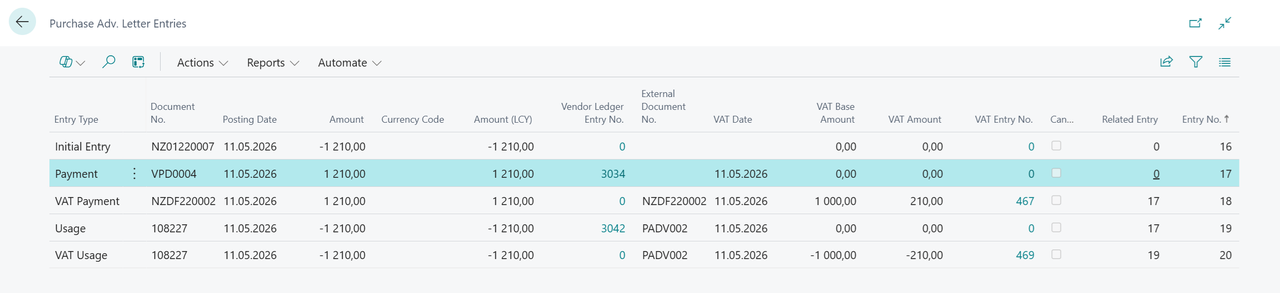

- Choose the line with Entry Type – Payment.

- Choose the Unlink Advance Payment action.

- A new entry with Entry Type – Payment and an opposite sign is created. If a VAT document (line with Entry Type – VAT Payment) existed for the payment, a new reversed VAT Payment entry is also created.

- The entry is reflected in the general ledger and VAT. New vendor/customer entries are created to reclassify the advance account to a standard balancing account.

Unlink a payment from advance via vendor or customer entries

You can also unlink payments directly from vendor or customer entries. From a customer entry that has a Document Type – Payment and Advance Letter No., use the Unlink Advance Letter function.

- Find the vendor or customer entry used to pay the advance letter.

- Choose Unlink Advance Letter.

- A new entry with Entry Type – Payment and an opposite sign is created. If a VAT document existed, a reversed VAT Payment is also created.

- The entry is reflected in the general ledger and VAT. New vendor or customer entries are created to reclassify the item from advance to a standard balancing account.

Retrospective payment assignment to an advance

If you post a vendor or customer payment without linking it to an advance, you can create the link later from vendor or customer entries.

To link a payment to an advance retrospectively:

- Find an open vendor or customer entry with Document Type = Payment.

- Choose Link Advance Letter.

- On the page that opens, choose New.

- In the Advance Letter No. field, select an available advance.

- Choose the advance, and confirm with OK.

- Confirm the linking page with OK.

- The payment is now linked to the advance. An entry with Entry Type – Payment, and possibly VAT Payment, is created. This entry is reflected in the general ledger and VAT. New vendor or customer entries are created to reclassify them from a balancing account to an advance account.

Unapply an advance from a posted invoice

If you mistakenly applied an advance to an invoice, you can remove the link.

Hinweis

This function has a few limitations:

- If multiple advances are applied to an invoice, they must all be removed together.

- The reversal uses the same posting and VAT date as the original.

- If the accounting period is closed or restricted, the reversal can't be done.

To unapply an advance from a posted invoice:

- Find the posted invoice linked to the advance.

- Choose Unapply Advance Letter.

- Confirm the dialog.

- The advance is unapplied. In advance entries, opposite Entry Type – Usage, and possibly VAT Usage, lines are created. These entries are reflected in the general ledger and VAT. New vendor or customer entries are created to reclassify them from a balancing account to an advance account.

Add an advance to a posted invoice

If an advance wasn't linked when you posted a sales or purchase invoice, you can add it later from the posted invoice by using Apply Advance Letter.

Hinweis

This function has a few limitations:

- The original posting and VAT dates are reused.

- Preview isn't available before posting.

- The advance amount can't exceed the remaining balance of the posted invoice. If the invoice was partially paid, adjust the advance amount manually.

- The system doesn't automatically adjust the applied amount. You must enter it manually.

To add an advance to a posted invoice:

- Find the posted invoice without linked advance.

- Use Apply Advance Letter.

- On the opened page, choose New.

- In the Advance Letter No. field, select an advance.

- Choose the advance, and confirm with OK.

- Repeat for more advances if needed.

- Adjust the Amount field so that it doesn't exceed the remaining invoice balance.

- Confirm the link with OK.

- The advance is now linked. Entries with Entry Type – Usage, and possibly VAT Usage, are created. These entries are reflected in the general ledger and VAT. New vendor or customer entries are created to reclassify them from balancing accounts to advance accounts.

Related information

Advance Payments for Czech Republic (extension)

Czech Local Functionality

Finance